Is there still a margin in store lamb trading?

In-brief

- Look for the trading opportunities that maximise the gross margin per unit of pasture consumed, but keep in mind your total margin will be dependent on consuming as much pasture as possible per hectare.

- Understanding your time period for trading and the DSE capacity during this time is key to maximising trading opportunities.

Introduction

For some producers, trading livestock is used as an opportunistic tool to utilise surplus pasture. For others, it is part of their core business. When it is core business you cannot be as opportunistic because you simply have to trade to make any money.

Due to a good season and high demand in the current market, available animals have been more expensive and slightly heavier which affect the margin that can be achieved. Understanding the key parameters that will affect a trade margin is key to assessing the merit of trade opportunities, and what strategy will achieve the best outcome within the constraints of the current market.

To gain some insight into how traders can assess their trading options and navigate the associated risk, this article provides an overview of the fundamentals of trading livestock and a case-study on trading store lambs in the current market.

Fundamentals of trading livestock

Defining trading parameters

On any farm there is usually specific time periods that are best suited to trading animals due to pasture feed supply. So, determining the number of days available and the total number of animals that you can trade during that time is crucial to your ability to successfully execute a trade.

Assessing the trading options

For producers trading at a large scale, the profitability of each trade and the number of trades they can execute are key to the profitability of their operation.

Margin per unit of pasture consumed

Comparing individual trades is best done using the gross margin per DSE. A DSE or dry sheep equivalent represents the metabolizable energy requirement to maintain a wether in average condition. With extra production (i.e. weight gain or reproduction) per animal comes extra energy requirements.

It is important to note that unlike breeding enterprises, trading animals are only on farm for a portion of the year. To compare trades that occur over different time periods, an annualised DSE rating needs to be calculated.

Annualised DSE rating = Average DSE rating per head / 365 days * Days on farm

Pasture consumed per hectare

In a perfect world, we would select the trade with the highest gross margin per DSE and replicate it as many times as possible to fill our entire trading period. However, if the trade with the highest gross margin per DSE occurs over a relatively short time period, there are a couple of constraints to consider:

- Reliance on being able to source enough animals to use the entire trading period.

- Access to enough capital to fund a higher number of purchases.

With these principles in mind, lets assess a real-life example.

Trading sheep for weight gain – a case study

Luke is a sheep producer based in south-eastern Australia. In addition to managing a composite ewe flock producing prime lambs, Luke relies on trading lambs to make up ~20% of his annual average DSE capacity on his property (3000 DSE) and therefore 20% of his grazing hectares (200 hectares).

With a large proportion of his property under irrigation, Luke’s trading window falls predominantly from November to April each year.

To manage market risk, Luke works on signing a forward contract with a processer each time he purchases lambs. This ensures Luke has a buyer for his lambs and that he is buying and selling in the same market. Forward contracting large numbers of lambs requires discipline to meet the target weight with the right number of lambs by a certain date.

Luke has historically purchased store lambs at 38 kg liveweight for approximately $140 per head, working on an average weight gain of 13 kg liveweight. Due to a good season and high demand, available store lambs are slightly heavier and more expensive at $160 per head. Luke knows there is still opportunity in trading these animals but to ensure that he maximises the return per hectare he will trade on, he wants to assess what weight gain he should target.

Not only will the target weight gain affect the number of animals he can trade, but the sale weight will affect the price received. One processer will accept heavier lambs, up to 32 kg dressed and will pay $8.10 per kg. The other processer will pay a premium for lambs at $8.50 per kg dressed, but only accepts lambs up to 27 kg dressed.

Margin per unit of pasture consumed

Table 1 demonstrates how to calculate the gross margin per DSE of an individual trade. Accounting for animal health costs, freight and selling costs, Luke works on about $7.50 per head in costs. If Luke targets 32 kg dressed, the final sale value of the lamb would be $259 per head, less purchases and direct costs would give a gross margin per head of $92. To convert this to gross margin per DSE in order to compare to other trades over a different time period, the gross margin per head is divided by the annualised DSE rating. The gross margin per DSE for this trade is $139 per DSE.

Table 1. Calculating the gross margin per DSE of a trade with a target sale weight of 32 kg dressed. The DSE ratings calculated in this analysis are determined by the expected growth rate and average liveweight during the trade. The expected growth rate is calculated daily and averaged across the trade based on an assumed relationship between weight and growth rate.

| SALE @ 32KG DWT | ||

|---|---|---|

| A – Purchase weight (kg lwt/head) | 40 | |

| B –Purchase price ($/head) | $160 | |

| D – Total costs ($/head) | $7.50 | |

| E – Target sale weight (kg dwt/head) | 32 | |

| F – Dressing % | 49% | |

| G – Sale price ($/kg dwt) | $8.10 | |

| I – Sale value ($/head) | I = G * E | $259 |

| K- Weight gain (kg lwt/head) | = (E /F) – A | 25 |

| L – Expected growth rate (g lwt/head/day) | 225 | |

| M – Days per trade | M = K / (L / 1000) | 112 |

| N – DSE rating per head | 2.2 | |

| O – Av. Ann. DSE rating per head | O = N / 365 * M | 0.7 |

| R – Gross margin ($/DSE) | R = (I – B – D) / O | $139 |

Given the variability in both weight gain and sale price depending on the final sale weight, Luke will need to compare the gross margin per DSE at each possible sale weight.

Using the same method as Table 1, Luke can compare multiple trades. For this analysis, the purchase price and weight will remain the same, with the sale weight being the key variable. The sale weight influences 4 parameters that affect the gross margin per DSE of the trade (Table 2).

Table 2. The parameters of the trading analysis from Table 1 that will change as the sale weight changes.

| Sale weight (kg dwt) | Price received ($/kg dwt) | Weight gain (kg lwt) | Days on farm | DSE rating |

|---|---|---|---|---|

| 32 | $8.10 | 25 | 112 | 0.66 |

| 31 | $8.10 | 23 | 103 | 0.61 |

| 30 | $8.10 | 22 | 95 | 0.56 |

| 29 | $8.10 | 20 | 86 | 0.53 |

| 28 | $8.10 | 18 | 78 | 0.48 |

| 27 | $8.50 | 17 | 70 | 0.43 |

| 26 | $8.50 | 15 | 62 | 0.38 |

| 25 | $8.50 | 13 | 53 | 0.32 |

| 24 | $8.50 | 11 | 45 | 0.27 |

| 23 | $8.50 | 9 | 37 | 0.22 |

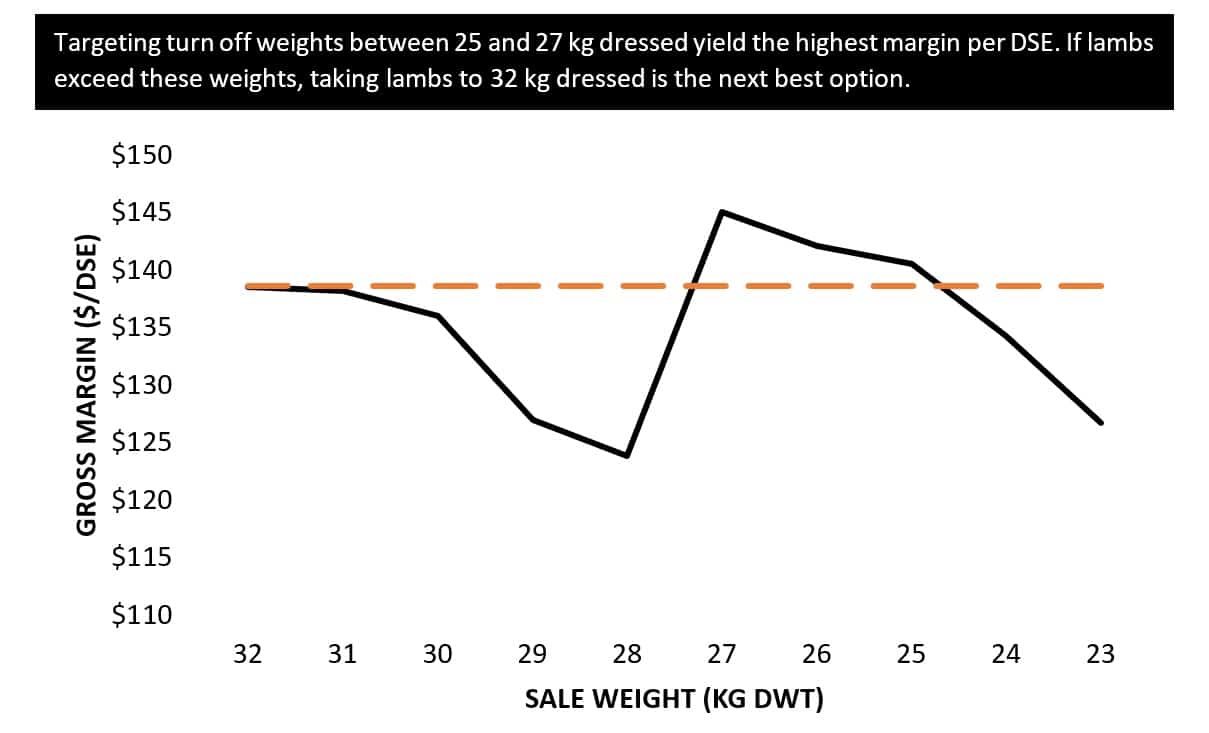

Figure 1 presents the gross margin per DSE (annualised) for each sale weight. Selling lambs at 27 kg dressed will return a higher gross margin per DSE than selling lambs at any other weight. This is due to being the highest weight at which Luke would receive a premium price per kg dressed weight.

It is important to note that this analysis is based on every lamb hitting a certain weight in the same time period, however in reality there will be a range around the target weight. For example, if Luke is targeting 27kg dressed, there will be certain percentage of lambs that will hit 1-2 kg above and below this target. It is particularly important as this target approaches the end of a pricing grid. To reduce the number of lambs exceeding 27 kg dressed, Luke would be better off targeting 25-26kg dressed.

Figure 1. Gross margin per DSE at each sale weight as per the assumptions in Table 1 and 2. Premium lamb price is paid up to 27 kg DWT.

Margin per hectare

The outcomes of this analysis highlight some key risks for Luke.

While in this analysis the shorter trade represents the best value per unit of pasture consumed, the margin per hectare across the trading period will be dependent on Luke’s ability to consume as much of the pasture produced as possible.

1. Targeting less weight gain over more animals If Luke was planning to trade the entire 3000 average annual DSE to 27kg dressed, he would need to source 7,000 lambs over the entire trading period. Because Luke would need to purchase the animals at different times to match his feed supply, there is risk in Luke not being able to source enough lambs when he needs them. If falls short of the total target lambs by 20%, there would be an opportunity cost of $87,000 across the trade or $435 per hectare.

2. Targeting more weight gain over less animals Luke may also choose to target 32 kg dressed weight due to having a similar gross margin per DSE. Luke would need 4,500 lambs to match his DSE capacity based on targeting a higher weight gain than the scenario above. If Luke is unable to hit this target and instead averages 30 kg dressed, it would equate to an opportunity cost of $73,000 across the trade or $365 per hectare. This is partly due to a lower gross margin per DSE, but mostly due to the fact that Luke would not have been able to increase the number of head required at this target weight.

There is significant risk in either trade option and to determine which is better Luke will need to assess which risk he could manage best.

Conclusion

The profit from trading livestock is highly dependent on the gross margin per DSE of an individual trade, and the ability to replicate the trade enough times to consume as much pasture as possible.

Understanding your trading period parameters allows you to make informed decisions about what trades you can successfully execute.

If you wish to learn more about livestock trading, you may want to read our guide on “Using Pasture Information When Deciding What to Trade.” You may also speak to one of our livestock specialists today for further information on getting a livestock loan.

Author

Aggregate Consulting is an agricultural consultancy business based in Wagga Wagga in southern NSW.